Home > Research > Research Overview > 2024 > The dynamics of a country's economic activities are examined using macroeconomic models.

The dynamics of a country's economic activities are examined using macroeconomic models.

Professor (Macroeconomics)

TAMEGAWA Kenichi

In March 2024, negative interest rates were lifted, and there were signs of adjustments to what has been referred to as "extraordinary" monetary easing. Such policy changes can affect key economic indicators, such as Gross Domestic Product (GDP) and the Consumer Price Index (CPI), although they may not always do so. The potential effects can be analyzed through macroeconomic models, which simulate the entire economy of a country using equations and diagrams. These models provide insights into how policy changes may influence GDP and inflation rates.

There are basic models that serve as a foundation and can be expanded to include the financial sector—essential for the economy—relax assumptions about rational behavior, or actively consider the heterogeneity of individuals (such as differences in productivity) that were less emphasized in earlier models. Research in various countries is progressing in this direction. In our laboratory, we are actively pursuing this trend by developing extended models based on existing basic models. We continually analyze how changes in the economic environment, such as fiscal and monetary policy, alter the responses of GDP and prices compared to the basic model.

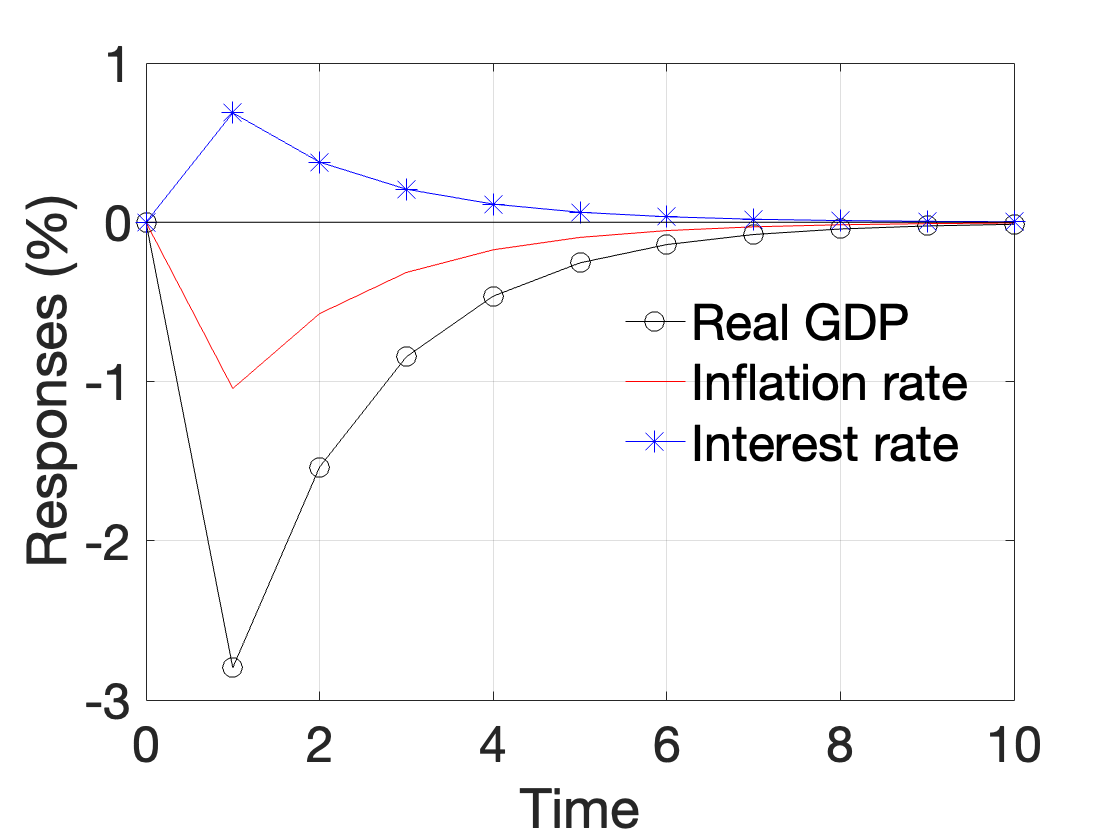

▲The figure represents a numerical simulation based on the basic model. The horizontal axis indicates time (in quarters), while the vertical axis represents percentages (%). The diagram illustrates how Real GDP, the inflation rate, and the interest rate change in response to an external shock, in which the interest rate rises by 1 percentage point during the first period. It shows how each of these indicators varies compared to the situation prior to the policy implementation.

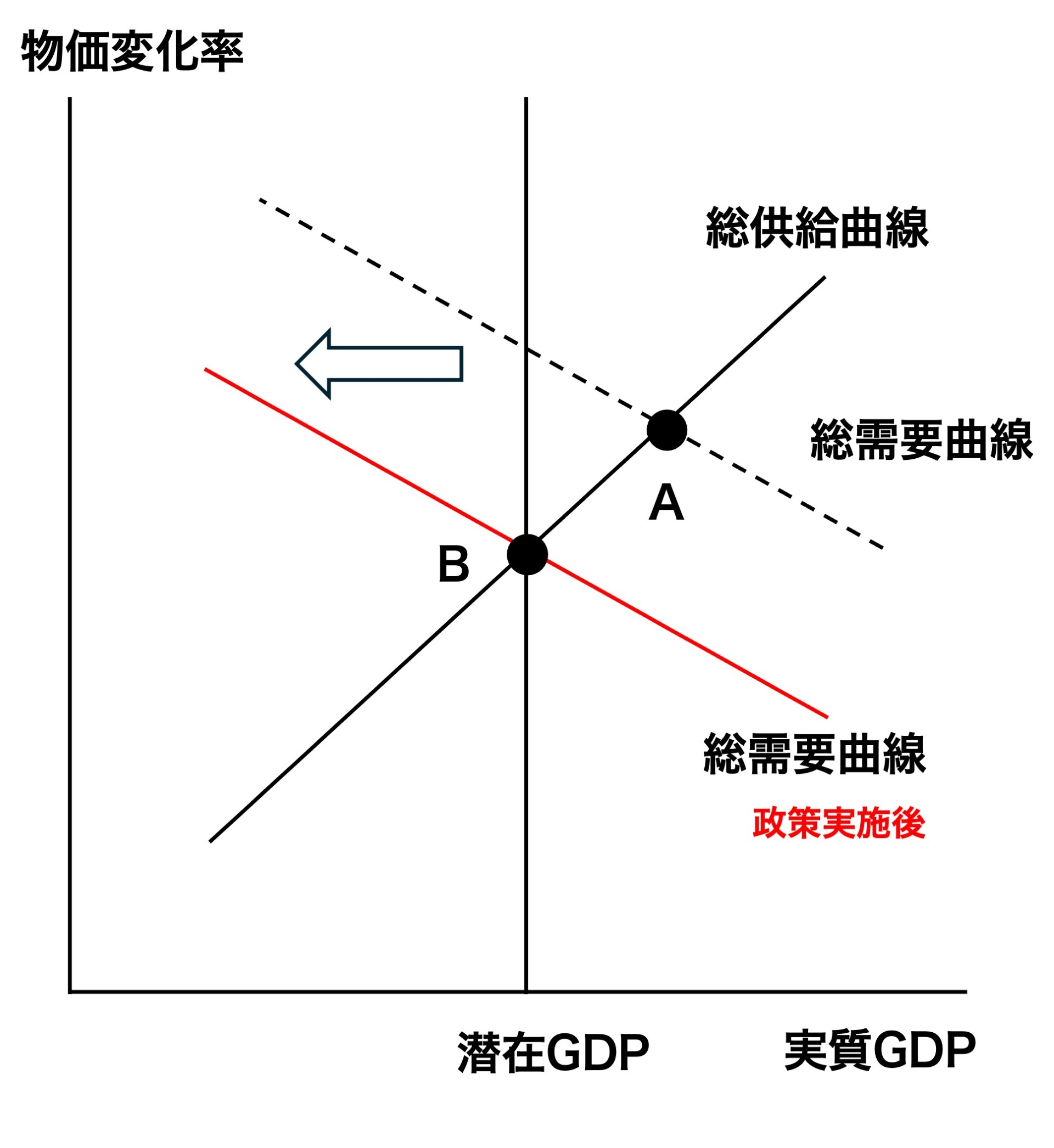

▲The figure represents a macroeconomic model known as the aggregate demand and aggregate supply model. In the upper part of the figure, it depicts how an overheating economy (Point A) is brought back to a normal economy (Point B) through contractionary monetary policy.

Related Links